If you’re a freelancer or remote worker earning in USD, you can now invest directly in U.S. and global markets.

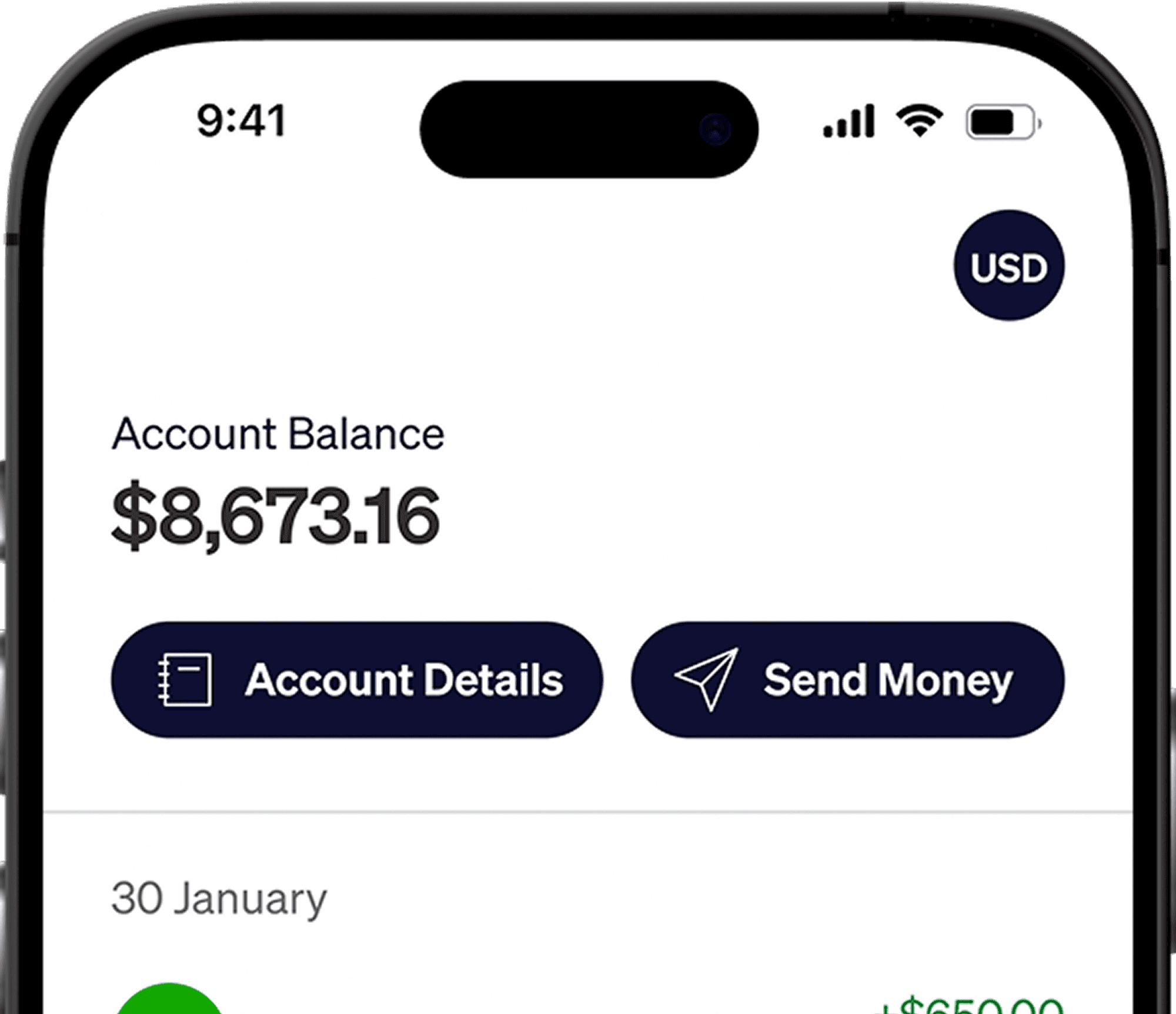

With Elevate Pay, funding an Interactive Brokers (IBKR) account is simpler than ever. You receive a U.S. bank account, which allows you to transfer funds to IBKR via ACH without dealing with international wire restrictions from local banks.

This guide explains:

What IBKR is

What you need to open an account

Step-by-step instructions

How to optimize your account after approval

What is Interactive Brokers (IBKR)?

Interactive Brokers (IBKR) is one of the largest global brokerage platforms. It is regulated by trusted authorities such as the U.S. SEC and the UK FCA.

Why many Bangladeshi investors choose IBKR:

Global Access: Trade stocks, ETFs, bonds, and more across 150+ markets

Low Fees: Commission structure is among the lowest globally

No Minimum Deposit: Start investing with small amounts

For freelancers earning in USD, IBKR provides access to international markets without needing a local intermediary.

The Elevate Pay Advantage: Solving the Funding Barrier

Historically, the biggest obstacle wasn’t opening the account, it was funding it. Local banks in Bangladesh typically restrict outward investment transfers without special approval.

The Elevate Pay solution:

Because Elevate Pay provides you with a U.S. routing and account number:

You can link it directly to IBKR

You can fund your account using PLAID (ACH)

Transfers are typically low-cost or free

Processing is faster than wire transfers

Important: This method is designed for users receiving USD through Elevate Pay (freelancers, remote workers, entrepreneurs).

Account Opening Requirements

To open an IBKR account as a Bangladeshi resident:

Age: 18+ (21+ for Margin account)

Residency: Legal resident of Bangladesh

Income Source: You must declare a legitimate source of wealth (e.g., "Income from Employment" or "Freelancing").

Required Documents

Prepare these before starting:

Category | Requirements & Details |

Proof of Identity (Mandatory) | • Passport (valid, signature page included) • National ID (Smart Card preferred, front & back) |

Proof of Address (Optional) | Required only in some cases (e.g., advanced permissions). Must be < 6 months old. • Bank statement (most reliable) • Utility bill • Credit card statement |

Tax ID (Optional) | • Enter your e-TIN if available • If not available, you may select “I’m unable to obtain a TIN” |

Step-by-Step: How to Open Your Account

The full application takes around 10–20 minutes.

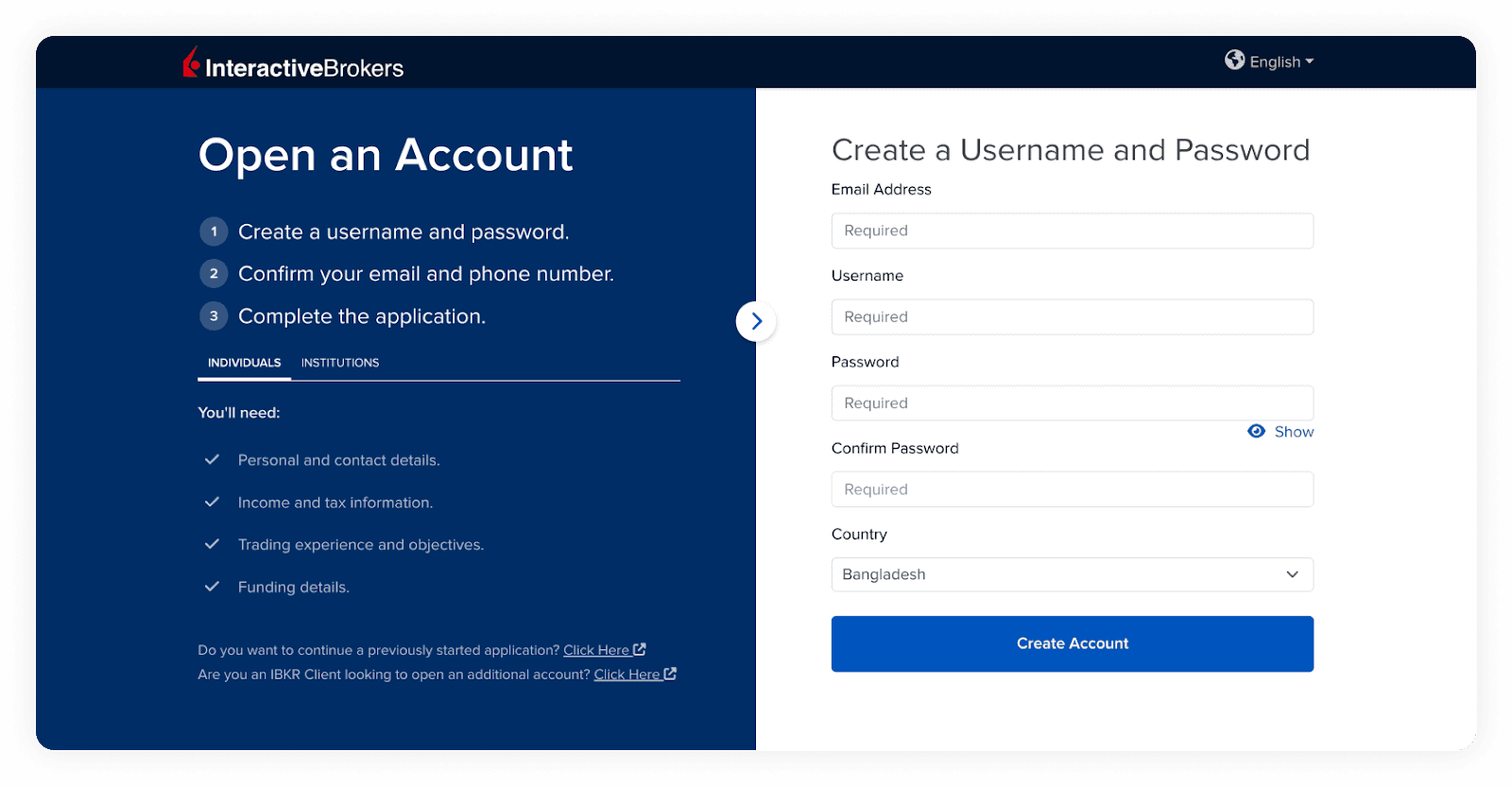

Step 1: Start the Application & Create Login

Visit the Interactive Brokers website

Click Open Account → Start Application

Enter your email, username, and password

Tip: Verify your email immediately to continue.

Pro Tip: Write down your login details securely. Recovery can be time-consuming.

Step 2: Select Account Type

Choose Individual

Set Country of Legal Residence: Bangladesh

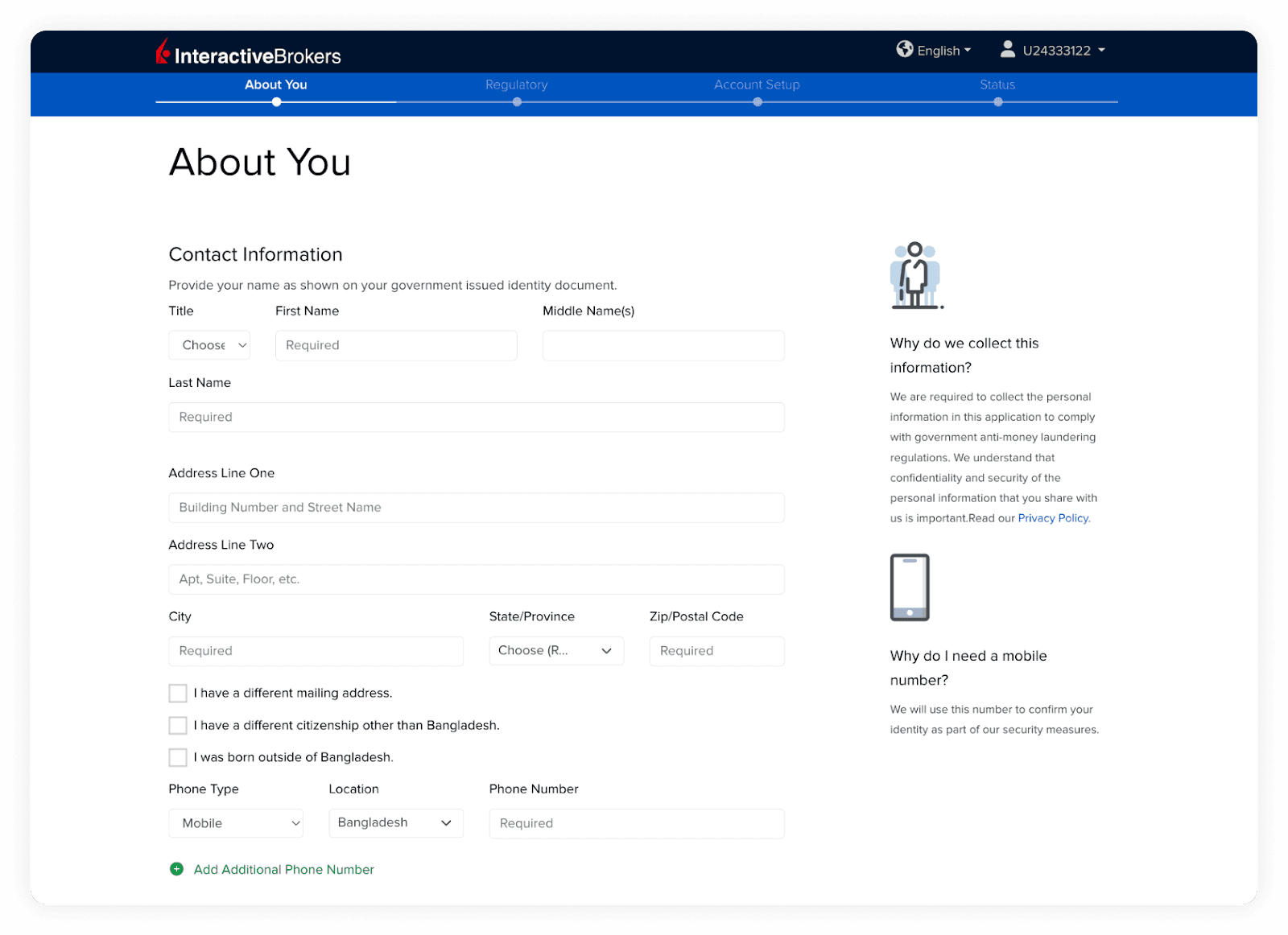

Step 3: Personal Information (Critical Step)

Enter your:

Full legal name

Address

Mobile number

Important:

Your name must match your Passport/NID exactly

Your address must match your ID document

Mismatches can delay approval.

Step 4: Tax Residency

Country: Bangladesh

Enter your e-TIN (if available)

If you do not have one, you can select that you are unable to obtain it (e.g., student).

Step 5: Employment & Source of Wealth

Employment Status: “Employed” or “Self-Employed”

Source of Wealth: Be honest (e.g., Income from Employment or Freelancing)

Base Currency: Select USD

Selecting USD prevents unnecessary currency conversions since you will fund via Elevate Pay.

Step 6: Trading Configuration

This section determines your risk level and permissions.

Account Type: Select Cash (Recommended for beginners)

You cannot lose more than your deposit

Margin involves borrowing and higher risk

Income & Net Worth: Ensure Net Worth is higher than Liquid Net Worth

Investment Objectives: Choose “Growth” or “Hedging”

Trading Experience:

Be honest

Selecting “No Experience” for everything may limit permissions

Stock Yield Enhancement Program: Optional — you can leave unchecked

Step 7: Review & Identity Verification

Review all information carefully

Sign digitally by typing your name

Identity Verification:

You may be asked to scan a QR code with your phone

Upload a photo of:

Passport or NID

Selfie

If mobile upload fails, desktop upload is available.

Approval Time: A few minutes up to 3 business days.

Post-Approval: Optimize Your Account

Once approved, adjust two key settings.

1. Switch to Tiered Pricing (Lower Fees)

IBKR often defaults to Fixed Pricing (minimum $1 per trade).

For small traders, Tiered Pricing can reduce costs (minimum ~$0.35 per trade).

How to switch:

Log in → Settings → Account Configuration → IBKR Pricing Plan → Select Tiered

Note: Takes 24 hours to apply.

2. Enable Fractional Shares

Fractional shares allow you to invest small amounts in expensive stocks (e.g., NVDA, MSFT). Without this, you must buy full shares.

How to enable:

Log in → Settings → Trading Permissions → Stocks → Check Global Trade in Fractions

Funding Your IBKR Account

Learn How to fund your Interactive Broker (IBKR) account with Elevate Pay using PLAID

Frequently Asked Questions (FAQ)

Is IBKR safe for Bangladeshi users?

Yes. IBKR is a publicly traded U.S. company with billions in equity capital. Client assets are segregated.

Do I need permission from Bangladesh Bank?

If you are using USD earned abroad and held in Elevate Pay (without entering Bangladesh), you are generally using your foreign earnings.

However, consult a qualified tax or financial advisor to ensure compliance.

Can I withdraw funds back to Bangladesh?

Yes. You can:

Withdraw from IBKR to Elevate Pay

Then remit from Elevate Pay to your local Bangladeshi bank or bKash.

Disclaimer: This guide is for educational purposes only and does not constitute financial advice. All investments carry risk.

Recent Articles

DO MORE WITH ELEVATE PAY

Transfer money with Elevate Pay with low fees and competitive FX rates. Our users love us for transparency, security and more.