For many Pakistanis, building wealth often feels like an uphill battle. You see people around the world investing in global markets, growing their savings steadily and safely, while options at home feel limited or unstable. Yes, you can invest in the Pakistan Stock Exchange, but if your income is in USD, why should your investments be restricted to PKR?

The good news is that you can invest in US and global stock markets from Pakistan. You can buy shares of companies like Apple, Nvidia, Google, or Microsoft. You can invest in ETFs, diversify internationally, and grow your wealth just like investors elsewhere.

The challenge is that when you start researching, the information quickly becomes confusing. Some platforms accept Pakistanis, others do not. Some allow real stock ownership, others only offer CFDs. Funding these platforms can be a headache because of high fees or poor FX rates. Banks ask questions, transfer rules change, and many apps simply do not work here.

If you’re feeling overwhelmed, you’re not alone. Most beginners have no idea where to start, and the internet is full of mixed, outdated, or incomplete advice. This guide cuts through the noise. We will explain everything clearly, simply, and in a way that makes sense for Pakistani residents.

But before we look at platforms, funding methods, or regulations, we need to understand an important foundation: the different ways you can actually invest in global markets. Not all “stock trading apps” are equal, and choosing the wrong one can lead to mistakes that cost time, money, and peace of mind. So let’s start with the basics.

Understanding the Basics: Different Ways You Can “Invest” in the Global Market

Before we talk about brokers and platforms, you need a clear understanding of what you can actually invest in. Most beginners lump everything together as “trading,” but stocks, ETFs, and CFDs are very different products. Knowing the difference will help you choose the right platform and avoid costly mistakes.

There are three main ways Pakistanis invest globally.

1. Buying Real Stocks (Actual Ownership)

This is the classic form of investing. When you buy real stock, you are buying a tiny piece of a company. You become a shareholder. If you buy one share of Apple or Microsoft, it legally belongs to you.

Real stocks are ideal for long-term investing because:

You benefit from the company’s growth

You can hold your shares for decades

You earn dividends if the company pays them

Your investment grows as the business grows

If your goal is wealth building or retirement planning, real stock ownership is the foundation.

2. Buying ETFs (A Basket of Stocks in One Investment)

ETFs, or Exchange-Traded Funds, are one of the most beginner-friendly investment products in the world. Instead of buying individual stocks one by one, an ETF lets you invest in hundreds of companies at once.

This makes ETFs incredibly powerful for beginners who want instant diversification. While the profits are usually not as high compared to stocks, this is a low risk option that beginners usually prefer.

Popular examples include:

S&P 500 ETFs that track the 500 largest companies in the US

Nasdaq ETFs that focus on tech companies

Total Market ETFs that cover almost the entire US stock market

Dividend ETFs for stable income

Sector ETFs like technology, healthcare, or energy

With a single ETF, you can build a balanced portfolio with very low risk.

3. Trading CFDs (You Do Not Own the Stock or ETF)

CFDs are the trickiest for beginners. Instead of owning the stock or ETF, you are simply betting on whether the price will go up or down. It is speculation, not investing.

CFDs often come with leverage, meaning you can gain a lot or lose a lot very quickly. These are generally not suitable for long-term investors or beginners.

Real investing happens with real stocks and real ETFs.

CFDs are for experienced traders who understand volatility and risk.

Now That You Understand the Types, Let’s Explore Your Platform Options

Once you know the difference between real stocks and CFDs, it becomes easier to decide which platform suits you.

Interactive Brokers (IBKR)

Interactive Brokers is the platform we recommend the most for anyone in Pakistan who wants real access to US and global stock markets. It is one of the world’s most trusted brokers, used by long-term investors, beginners, and even professional traders. The best news is that IBKR officially accepts Pakistani residents, making it one of the safest and most compliant options available.

Signing up is simple. During the application process, you will be asked to provide:

Your CNIC

A proof of address such as a utility bill or bank statement

Basic personal and financial details

Bank information for deposits and withdrawals

Once your account is approved, you can invest in thousands of US stocks, ETFs, and global markets. IBKR is known for its extremely low commissions. For Pakistani users, the standard fee for US stock trades is generally USD 0.0035 per share with a minimum of USD 0.35 per trade, which is significantly cheaper than many retail brokers globally. There are no hidden charges for maintaining an account, and no inactivity fees.

The biggest challenge for people in Pakistan has always been funding the account. Traditional bank wire transfers are expensive, slow, and often require SBP declarations and additional paperwork. When you add the high currency conversion costs imposed by banks, the entire process becomes frustrating. This is where Elevate Pay makes a huge difference.

With Elevate Pay, you can fund your IBKR account through ACH instead of costly wire transfers. ACH deposits are smooth, fast, and cost a simple fixed fee of $1, giving you a far cleaner and more affordable way to move your USD income directly into your investment account. No PKR conversions, no high bank fees, and no long waiting periods.

Elevate Pay removes the funding barrier so you can start investing globally without friction.

Whenever you are ready to begin, Interactive Brokers remains the safest, most reliable, and most cost-efficient platform for long-term investing from Pakistan.

CapTrader

CapTrader is another platform available to investors in Pakistan, and it operates on top of the same global trading infrastructure that powers Interactive Brokers. You can think of it as an alternative interface for accessing the IBKR ecosystem, but with additional tools that appeal to more advanced or technical users.

CapTrader is especially popular among investors who want deeper control over their trades, prefer advanced charting tools, or want to integrate algorithmic or automated strategies. Because it connects to IBKR’s network, you still get access to the same wide range of real US stocks, ETFs, and global markets.

Unlike Interactive Brokers, CapTrader requires a higher starting deposit. To open an account, you typically need a minimum balance of around USD 2,000. Signing up also involves verifying your identity and providing standard documentation similar to IBKR, such as your CNIC, proof of address, and financial information.

In terms of fees, CapTrader is competitively priced. US stock trades usually start at USD 0.01 per share with a minimum of USD 1 per trade. While this is slightly higher than IBKR, it remains low compared to many international brokers.

For most long-term investors in Pakistan, IBKR is simpler and more affordable. However, if you are someone who wants more technical tools, prefers a different interface, or plans to experiment with automated trading, CapTrader can be a strong alternative. It delivers the same global market access, just wrapped in a platform geared toward more active and experienced traders.

Alpaca

Alpaca is a unique option because it was originally built as an API-first brokerage rather than a traditional retail platform. Its main purpose is to power other investment apps, trading tools, and automated strategies. Because of this, Alpaca does not officially support retail onboarding from Pakistan. However, some Pakistani users do still manage to create accounts and access real US stocks and ETFs.

The biggest challenge with Alpaca is not the trading itself, but the funding. Since ACH transfers work only inside the United States, Pakistani users cannot use ACH to deposit money into Alpaca. Instead, they must rely on international wire transfers, which are slower, more expensive, and subject to SBP’s documentation requirements at local banks. This makes Alpaca significantly less convenient compared to IBKR, especially for recurring deposits.

Another issue is that Alpaca’s KYC approval for Pakistan is inconsistent. Some applicants get accepted, while others do not, and Alpaca does not offer clear guidance on eligibility for Pakistani residents. This uncertainty makes it difficult for beginners to rely on the platform.

That said, Alpaca still appeals to a small group of users who want a clean, minimal interface, fractional investing, or the ability to connect trading bots and algorithms directly to their brokerage account. Once an account is approved and funded, Alpaca offers a simple and low-cost experience.

For most people in Pakistan, Alpaca is usable only in a limited or unpredictable way. Funding friction, inconsistent onboarding, and the absence of local support make it a secondary choice rather than a primary one. Platforms like Interactive Brokers remain far more reliable for Pakistani investors.

IG Markets

IG Markets is one of the most well-known global trading platforms, trusted for its strong regulation and long history in financial markets. It is regulated by the UK’s Financial Conduct Authority, which gives it a high level of credibility. However, what IG allows you to trade depends heavily on your country of residence, and for Pakistan, IG’s offering is very different from brokers like Interactive Brokers.

For Pakistani residents, IG does not provide access to real US stocks or ETFs. Instead, it offers trading through CFDs, which are synthetic contracts that track the price of underlying assets. This means that when you “trade” a US stock or index through IG, you are not buying real shares. You are only speculating on price movements. CFDs often come with leverage, which means both profits and losses can move much faster than with regular stock investing.

For experienced traders who understand charts, volatility, and short-term strategies, IG can be an interesting platform. It is built for fast, active trading and has excellent tools for technical analysis. But for beginners, and especially for long-term investors looking to build wealth, CFDs are not the right starting point. They carry much higher risk, and a single wrong move can wipe out your investment.

In simple terms, IG Markets is a trading platform for short-term speculation, not for long-term investing. If your goal is to own real US stocks, build a global portfolio, or invest in ETFs, IG is not the right choice. Platforms like Interactive Brokers or CapTrader are far more suitable for those goals.

PSX ETFs

If you prefer to stay completely local or want to start small, Pakistan’s stock exchange offers a handful of ETFs, such as gold and index trackers. These can be bought in PKR through any Pakistani brokerage. They offer some diversification but cannot replace true global investing. Think of them as a secondary option rather than a main strategy.

Finqalab: An Easy Starting Point for Local Investing

For many beginners in Pakistan, jumping directly into US markets can feel overwhelming. Finqalab is a helpful starting point because it makes local investing on the Pakistan Stock Exchange simple and beginner friendly. The app works with Next Capital Limited, a licensed and regulated PSX broker, so every user gets a proper CDC sub-account with full regulatory protection.

Finqalab allows completely digital onboarding, meaning you can open a PSX trading account from your phone without any paperwork. Once you are in, the app lets you buy and sell local stocks, track your portfolio, view real time data, and study up to five years of stock history. Funding and withdrawals can be handled inside the app, which makes the overall experience smooth for first time investors.

One of Finqalab’s strongest features is its educational support. Through Finqalab Academy, users get free courses and beginner friendly content on saving, budgeting, stock investing, and personal finance. This helps new investors build confidence before moving on to more advanced platforms.

Although Finqalab does not provide direct access to US or global stocks, it still plays an important role. It allows Pakistanis to start investing with small amounts, often as low as five thousand rupees, and learn how markets work in a safe, familiar environment. Users can also invest in local ETFs and companies that offer limited indirect exposure to global markets.

In simple terms, Finqalab is a practical and accessible first step for anyone who wants to learn the basics of stock investing in Pakistan before exploring international platforms later on.

Here is a clean, beginner-friendly comparison table tailored specifically for Pakistan-based investors. It highlights the features that matter most: availability, type of investing, funding difficulty, minimum deposit, fees, and overall suitability.

How the Platforms Compare

Feature / Platform | Interactive Brokers (IBKR) | CapTrader | Alpaca | IG Markets | Finqalab (Local) |

Accepts Pakistani Applicants | Yes | Yes | Unofficial / inconsistent | Yes | Yes (local only) |

Type of Investing | Real stocks and ETFs | Real stocks and ETFs | Real stocks and ETFs (if account approved) | CFDs only (no real ownership) | PSX stocks and ETFs |

Best For | Long-term investing, beginners to advanced users | Advanced users, algorithmic traders | Tech-savvy users willing to handle workarounds | Short-term traders, forex & CFD trading | Beginners learning PSX investing |

Minimum Deposit | No strict minimum | About USD 2,000 | None officially, but approval unpredictable | Varies by product | As low as Rs. 5,000 |

Funding from Pakistan | Wire/ACH | SEPA/Wire | Wire/ACH | Wire/ACH | Local PKR deposits |

Ease of Funding | Moderate with bank wires, very easy with Elevate Pay ACH | Moderate to difficult | Difficult (wires required) | Moderate | Very easy |

Fees (US Stocks) | About USD 0.35 minimum per trade | About USD 1 minimum per trade | Zero commission | Spread-based pricing (CFDs) | Local brokerage fees |

Regulation | Highly regulated US broker | EU-based, uses IBKR routing | US-based but limited regional support | FCA regulated | PSX, SECP regulated |

Beginner Friendliness | High | Medium | Medium to Low | Low | Very High |

Key Challenges Pakistanis Face When Investing Globally

Understanding platforms is only half the story. Pakistanis face unique challenges when trying to invest abroad, especially when it comes to sending money.

One major issue is documentation. Most international brokers require identity verification, proof of residence, and proof of income. This is normal and part of global AML (Anti-Money Laundering) regulations.

Another major challenge is funding. Most US brokers only accept USD wire transfers. Pakistani banks can send international transfers, but they often require declarations, approvals, and sometimes charge high fees. On top of that, currency conversion from PKR to USD through local banks can be expensive.

Finally, SBP regulations can change. There may be times when banks tighten rules for outward remittances or require additional documentation. These changes can affect your ability to send money abroad.

How Elevate Pay Makes Global Investing Much Easier for Pakistanis

One of the biggest obstacles for Pakistanis investing globally is simply having access to USD. Traditional banks make it difficult, you’re forced to convert your earnings into PKR, you face high spreads, and international transfers come with friction.

This is exactly where Elevate Pay becomes a game-changer.

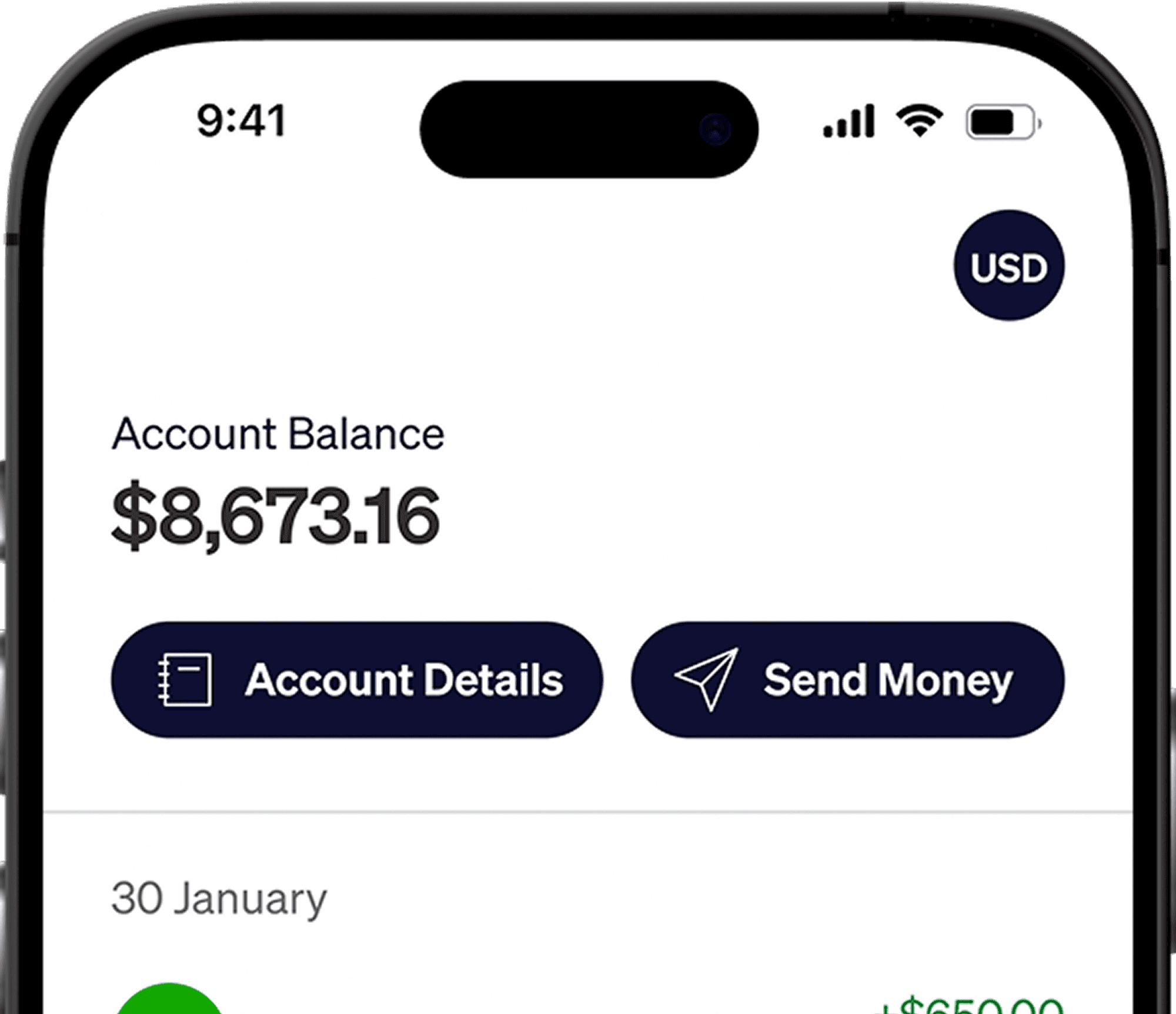

Elevate Pay gives Pakistani freelancers, remote workers, creators, and online earners access to a real USD account, letting them receive and hold their income directly in dollars. This eliminates the need to constantly convert USD to PKR, which not only preserves your earnings but also gives you far more financial flexibility.

If you are planning to invest globally, having a dedicated USD account is a huge advantage. First, you already have the currency needed for funding platforms like Interactive Brokers. Second, you avoid unnecessary bank conversion losses. Third, you can save and accumulate USD over time, making it easier to invest when the opportunity arises. For many Pakistanis, the biggest barrier is not opening a brokerage account, it’s simply having USD in the first place. Elevate Pay solves this.

By holding your income in USD, you can plan your investments better, avoid PKR volatility, and move money more efficiently when you’re ready to invest. For anyone earning in USD or hoping to invest globally, Elevate Pay significantly smooths out the entire journey.

So, Which Platform Should You Choose?

Your choice depends on your goals:

If you want to buy real stocks and hold them long-term → Interactive Brokers is the best option.

If you want advanced or automated trading tools → Captrader is a solid choice.

If you want to trade forex or CFDs and understand the risks → IG Markets works well.

If you want simple Pakistan-based exposure → PSX ETFs are okay but limited.

And if you want the easiest way to manage USD for investing → Elevate Pay gives you the USD account you need to make the process smoother.

Final Thoughts

Investing globally from Pakistan may seem complicated at first, but once you understand the different types of trading, the available platforms, and how funding works, it becomes far more manageable. The real key is choosing the right type of investing for your goals. If you want to build real wealth, buying actual stocks through a platform like Interactive Brokers is the most straightforward and secure path.

And with tools like Elevate Pay giving Pakistanis easier access to USD accounts, the biggest hurdle, funding, is finally becoming manageable.

Recent Articles

DO MORE WITH ELEVATE PAY

Transfer money with Elevate Pay with low fees and competitive FX rates. Our users love us for transparency, security and more.