In the heart of Europe, Belgium is not just known for its rich history, delectable chocolates, and medieval cities, but also for its robust financial services sector that has embraced technology to enhance its offerings. The rise of fintech in Belgium has revolutionized how individuals and businesses handle their finances, providing innovative, user-friendly, and efficient solutions that cater to various financial needs. In this article, we will explore the top seven fintech solutions in Belgium, highlighting their features and the benefits they bring to consumers and businesses alike.

1. Payconiq

Overview

Payconiq is a mobile payment solution that allows consumers to make payments directly from their bank accounts using a smartphone app. Launched in 2015, this Belgian fintech has gained considerable traction due to its simplicity and the widespread acceptance by merchants across the country.

Features

Instant Payments: Users can send and receive money instantly, making transactions quick and convenient.

QR Code Payments: Payconiq offers a QR code scanning feature that facilitates payments at physical stores, enhancing the shopping experience.

Bill Splitting: The app enables users to split bills easily among friends and family, making it a popular choice for social gatherings.

Benefits

For consumers, Payconiq has simplified the payment process, reducing the need for cash and cards. For businesses, it offers a low-cost payment solution that is easy to integrate, ensuring a seamless transaction experience.

2. KBC Mobile Banking

Overview

KBC is one of Belgium's largest banking and insurance institutions, and its mobile banking app is a standout fintech solution in the country. KBC Mobile Banking combines traditional banking services with a modern digital experience, allowing users to manage their finances on-the-go.

Features

Comprehensive Banking Services: Users can check balances, transfer funds, pay bills, and apply for loans all through one app.

Integrated Financial Planning Tools: The app offers insights into spending habits and financial goals, helping users make informed financial decisions.

Easy Investment Options: KBC allows users to invest in funds right from the app, catering to both novice and experienced investors.

Benefits

KBC Mobile Banking enhances user engagement through its intuitive interface, while its comprehensive features address various financial needs, making it a one-stop solution for customers.

3. Belfius Mobile

Overview

Belfius Bank, another prominent player in the Belgian financial landscape, has developed its mobile app, Belfius Mobile, which brings a range of banking services to users’ fingertips.

Features

Real-time Notifications: Users receive real-time notifications for transactions, helping them monitor their accounts closely.

Secure Messaging: The app allows users to communicate securely with their bank advisors, facilitating personalized financial advice.

Savings Goals: Belfius Mobile includes features that let users set and track savings goals effectively.

Benefits

Belfius Mobile not only promotes transactional efficiency but also enhances customer service through direct communication channels with advisors, making banking more personal and engaging.

4. Wealthsimple

Overview

Wealthsimple is a Canadian fintech that has made significant inroads into the Belgian market, focusing on investment management. It offers a unique approach to wealth management by targeting millennials and first-time investors.

Features

Robo-Advisory Services: Wealthsimple uses algorithms and data analysis to create personalized investment portfolios for users based on their risk appetite.

Socially Responsible Investing: Users can choose to invest in portfolios that adhere to ethical practices, catering to the growing demand for sustainability.

No Account Minimums: This feature makes investing accessible to everyone, regardless of financial status.

Benefits

Wealthsimple demystifies investing for novice investors, offering an easy entry point into the world of finance while promoting socially responsible choices.

5. Lendix

Overview

Lendix, now known as October, is a leading European marketplace lending platform that connects businesses seeking loans with individuals looking to invest in these loans. This fintech solution has a robust presence in Belgium and is reshaping the small and medium-sized enterprise (SME) financing landscape.

Features

Direct Lending: Businesses can apply for loans directly from the platform, and investors can choose which businesses to fund based on their financial profiles.

Transparent Processes: The platform provides transparent information regarding the risks and returns of each lending opportunity.

Low Fees: The platform charges lower fees compared to traditional lending institutions, benefiting both borrowers and investors.

Benefits

Lendix democratizes access to capital for SMEs, enabling them to secure funding quickly and efficiently, while investors gain the opportunity to earn returns on their investments by supporting local businesses.

6. Mobito

Overview

Mobito is another mobile payment service that is specifically tailored for the Belgian market. It enables users to make online and offline payments quickly and easily, targeting both consumers and businesses.

Features

Multiple Payment Options: Users can link their bank accounts or credit cards to the app, offering flexibility in payment methods.

Group Payments: Mobito allows users to create groups for social payments, similar to Payconiq, making it ideal for outings or group purchases.

User-Friendly Interface: The app is designed for simplicity, ensuring that users can navigate and complete transactions effortlessly.

Benefits

Mobito streamlines payment processes for consumers, making it easier to manage everyday expenses and payments while offering businesses a low-cost alternative to traditional payment processing systems.

7. Datanomik

Overview

Datanomik is a data analytics fintech that provides businesses with deep insights into their financial performance through advanced data analytics tools. In a data-driven economy, Datanomik empowers companies to make informed financial decisions.

Features

Customized Dashboards: Users can create dashboards that track specific financial metrics relevant to their business, allowing for better visualization of financial data.

Predictive Analytics: Datanomik uses AI and machine learning to forecast financial trends, enabling businesses to anticipate future financial challenges or opportunities.

Integration with Existing Systems: The tool integrates with various accounting and ERP systems, reducing the friction in data migration.

Benefits

By leveraging data analytics, Datanomik helps businesses optimize their financial strategies, enhance operational efficiency, and stay ahead of market trends.

Conclusion

The Belgian fintech landscape is flourishing with innovative solutions designed to address the evolving financial needs of consumers and businesses alike. From seamless mobile payment systems like Payconiq and Mobito to comprehensive banking applications like KBC Mobile Banking and Belfius Mobile, fintech in Belgium is enhancing user experience and financial accessibility. On the investment side, platforms such as Wealthsimple and Lendix (October) are breaking down barriers for investors and entrepreneurs, promoting financial inclusivity.

As financial technology continues to evolve, Belgium remains at the forefront of fintech innovation in Europe. The solutions highlighted in this article not only simplify financial processes but also foster a culture of financial literacy, helping users make informed and responsible financial decisions. The future of fintech in Belgium is bright, and with continued investment and innovation, it will further cement the country’s position as a key player in the global fintech arena.

Recent Articles

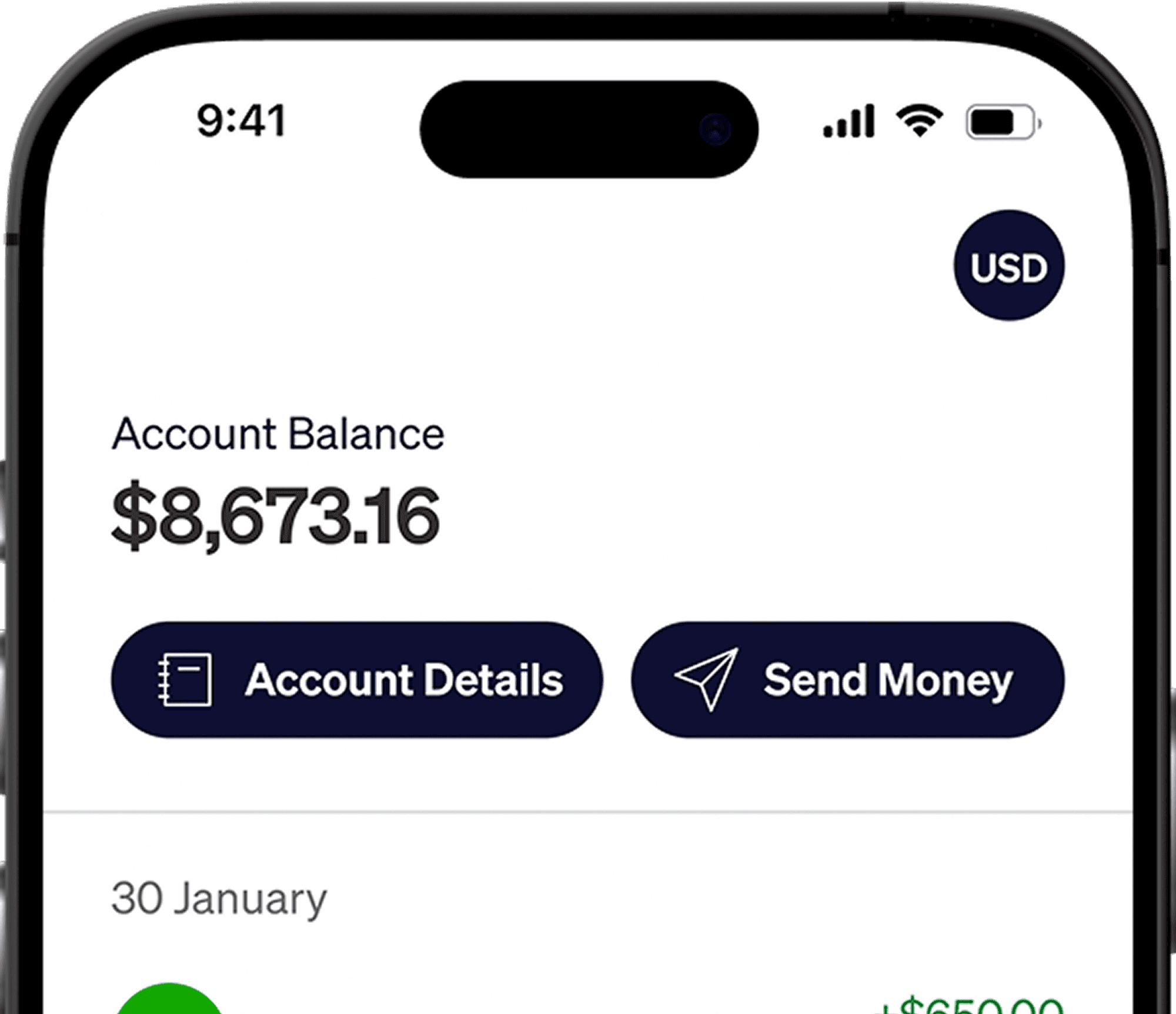

DO MORE WITH ELEVATE PAY

Transfer money with Elevate Pay with low fees and competitive FX rates. Our users love us for transparency, security and more.