Kicking off your freelance or remote work career is nothing short of a milestone. It takes years of experience and efforts to streamline global income while working from the comfort of your home. When you finally achieve this, you want processes to settle down and let you work in peace.

However, one major contributor to this peace—your partner payment platform—is often overlooked. Looking for the right payment solution, you jump from one solution to another only to find new incompetencies, such as poor FX rates, high fees, etc., waiting for you.

Digital wallets and freelancer accounts in Pakistan from local banks are the few options that remote workers have. But they always feel like an outdated solution, charging you unreasonable fees for primary usage. This is why you need a state-of-the-art solution tailored to your needs.

Why Do Freelancers Require A Unique Payment Solution?

Remote workers are connected to clients and freelance platforms worldwide. This connection means that their payments follow a unique path to finally end up in an account where they can make the most of their hard-earned money.

Therefore, local accounts and payment solutions can not always meet your international needs. As a result, you start looking for international payment solutions only to find out they are more focused on their Western customers and offer little support in your region. Hence, Elevate Pay was introduced and has since been Pakistan's go-to solution for freelancers' accounts.

Before we compare all your options, let’s talk about what an ideal solution should contain.

What Should You Look For in a Freelance Payment Solution?

While the priorities may vary from user to user, there are a few things that every digital nomad looks for in their payment solution.

Security

Digital banking comes with the risks of advanced digital fraud. Therefore, security is a top priority for every user. You must understand the security measures your payment solution takes to safeguard your funds.

Fees

Another critical factor is how you are charged for using these services. You do not want to pay a fortune for services you can get elsewhere for peanuts. Only a payment platform that understands your efforts to earn a global income will charge you fairly.

FX Rates

When you're getting paid from around the globe, exchange rates leave a heavy mark on your paycheck. You need a payment platform that's got your back with killer FX rates and fees. Watch out for those sneaky services that lure you in with great rates but then hit you with hefty fees – or vice versa.

Accessibility

You need an account that allows you to use your funds on the go. A responsive and active mobile app that is easily accessible and allows quick transfers as required.

Customer Service

As you use any solution, circumstances occur when you need the company’s customer service to step in. In that hour, you require a responsive customer service team ready to help you and solve your problem.

Transparency

Before setting up an account, try to get all the information, such as fees, charges, FX rates, etc. If these things are unclear and the company is not upfront about these details, chances are these things will not go your way. Only opt for options that are completely transparent about such details.

Support For Pakistan

If you have a tailored solution specific to your region, they can assist you better. Challenges can occur due to changing political situations or other domestic reasons. A region-specific solution at this hour will solve problems accordingly. Western solutions may only be able to provide little or no support in such situations.

Top Freelancer Bank Accounts in Pakistan

In Pakistan, freelancers have multiple solutions, from local banks offering freelancer accounts to digital wallets, which provide more flexibility. Western solutions also exist that offer different conveniences. Let’s dive into all these options.

Traditional Banks

Almost all traditional banks in Pakistan offer freelancer bank accounts. Let’s examine some of these accounts and what they offer.

HBL Freelancer Account

HBL allows freelance customers to receive payments in multiple currencies using the freelancer account. This is a current account, and there are no details about whether a savings account will be offered soon. You can use the freelancer account to receive funds directly from freelance platforms or overseas clients.

However, the account is a PKR account, and all funds received will be converted to PKR. You can open an Exporter’s Special Foreign Currency Account (ESFCA) and link it to your freelancer account. This will allow you to retain 50% of your savings in the earned currency.

While you can open the account online, the documentation required is quite complex. HBL does not provide details on a freelancer account's fees and conversion rates. However, local banks are known to charge more than most modern solutions.

Meezan Freelancer Account

Meezan Bank is another local bank renowned for its exceptional services. They also offer a freelancer account catering to the needs of a Pakistani freelancer. Meezan Bank’s freelancer account can be a current or a savings account.

Your account will primarily be a PKR account, but you can link it with an ESFCA account and receive payments in a different currency. There is an option for foreign currency retention accounts for USD. While the exact conversion rates are not specified, the account allows freelancers to retain up to USD 5,000 per month or 50% of their freelancing remittance income, whichever is higher. The account can be opened digitally without visiting a branch; no initial deposit is required.

While other major banks, such as Standard Chartered, UBL, Alfalah, etc., also offer freelancer accounts, they all have similar terms and limitations.

Digital Wallets

Another option for Freelancers is to opt for digital wallets. While they do not offer the conveniences of a physical branch, digital wallets come with other benefits like lower fees, transaction tracking, etc. Let’s talk about some digital wallets that Pakistani freelancers can consider.

Payoneer

Payoneer is an international e-wallet that has long been available to Pakistani freelancers. As a solo player in the market in the past, Payoneer has gained a strong footing. However, using this to its advantage, Payoneer charges higher fees and offers poor conversion rates. Starting with Payoneer in Pakistan requires essential documentation, and you must also have a local bank account.

Payoneer gives you a multi-currency account that you can use to receive global payments. You can then transfer those funds to your local bank account. Since Payoneer primarily focuses on b2b payments, it is not the most economical option for freelancers.

Being a Western platform, Payoneer does not offer the best support and convenience to its customers in Pakistan. It is more tailored towards the Western markets and does not cater to the challenges of emerging economies.

SadaPay

SadaPay is Pakistan’s local digital wallet and has recently emerged as a brilliant solution for freelancers. SadaPay offers a SadaBiz account, which allows freelancers to receive payments from anywhere in the world.

Every time you need to get paid, the SadaPay app generates a link that you share with your client to get paid. Your client can pay you using their credit or debit cards. This option only works with cards and does not require a SWIFT code. However, with that comes the disadvantage of the card processing fee, which increases the cost of using this solution.

You can also use SadaPay with freelance platforms. In that case, SadaPay works as a local bank, and you will transfer funds just like you would to any local bank account.

US-Based Banking

One unique option for digital nomads in Pakistan is US-based banking. That means getting a bank account in the US with Elevate Pay as a Pakistani citizen. Let’s talk about how that Works.

Elevate Pay

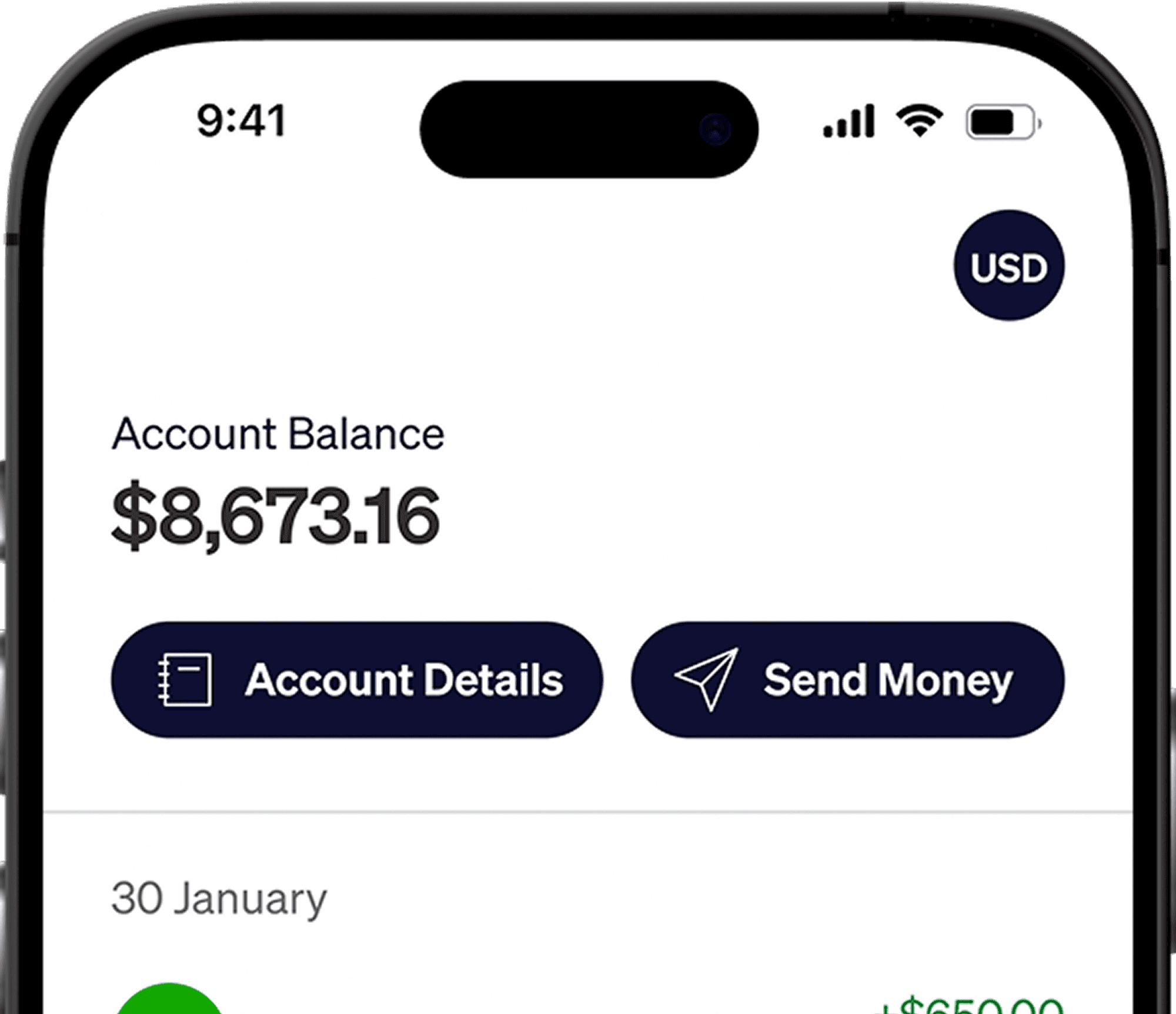

Elevate Pay is changing the dynamics of emerging markets and bringing them a much-needed solution. With Elevate Pay, you get a US-based USD account, so you get the services of a US bank in Pakistan.

Knowing the challenges of freelancers in Pakistan, Elevate Pay is designed to cater to the needs of digital nomads in emerging economies. Whether is it is getting a free USD account, understanding US-based account details, or getting the best FX rates, Elevate Pay does it all.

You can receive funds in your Elevate Pay account and hold them in USD for as long as you wish, which will help you win the battle against inflation. Additionally, you can transfer funds to your local bank account or digital wallet with the most amazing FX rates and a flat fees of $1.50. It gets even better; you get an account number and a routing number for your account that you can use to receive USD from anywhere in the world.

Elevate Pay pairs this with state-of-the-art security features to protect your funds and transactions. Signing up and starting with USD banking is a simple three-step process.

Also Read: Top 5 Freelancing Websites in Pakistan

Wrapping Up

As a digital nomad in Pakistan, choosing the right payment partner is always confusing. With this information, you get a good bird’s eye view of all the freelancer accounts in Pakistan and how they work. You can categorize them and see where you perfectly fit in.

Traditional banks seem more reliable because of their longstanding history in the country, but catering to freelance needs is not their forte. Digital wallets, on the other hand, offer a great solution for some, but there are challenges like retaining funds in foreign currencies.

US-based banking is new but offers the best of both worlds: inexpensive transfers to local accounts and a USD account in the USA to retain funds. You should easily be able to make the right choice that is in your best interest.

Recent Articles

DO MORE WITH ELEVATE PAY

Transfer money with Elevate Pay with low fees and competitive FX rates. Our users love us for transparency, security and more.