In the intricate web of global economics, the scarcity of US dollars within a nation's economy can unleash a ripple effect with profound consequences for its workforce. As international trade, investment, and economic growth hinge on the availability and stability of foreign currency, particularly the almighty US dollar, understanding the intricate impact of dollar shortages on a country's labor force becomes imperative. In this article, we delve into the depths of this phenomenon, unraveling its implications on employment, wages, living standards, and the socioeconomic fabric at large.

Operational Quagmire and Investment Slump

Dollar shortages cast a shadow of uncertainty on business operations, leading to a slump in investment that reverberates throughout the job market. The dearth of dollars constrains the import of vital raw materials, machinery, and technology, suffocating production capabilities and eroding competitive prowess. Businesses, caught in the grip of currency scarcity, face the grim choice of laying off employees, implementing hiring freezes, or even succumbing to closure. Consequently, the dearth of investment opportunities stemming from currency instability stifles economic growth and casts a shadow over employment prospects.

Currency Depreciation and Inflationary Pangs

Dollar shortages seldom come alone, often accompanied by the twin spectres of currency depreciation and inflationary pressures. As a nation grapples with dollar scarcity, its currency experiences devaluation vis-à-vis the US dollar, inflicting higher import costs on businesses. The aftermath is a surge in domestic prices, thrusting essential goods and services beyond the reach of citizens. The real wages of workers shrink, their purchasing power erodes, and the struggle to meet basic needs intensifies. Amidst this inflationary tempest, socioeconomic disparities deepen, exacerbating the plight of the working population.

Remittances and Migrant Workers

Dollar shortages leave an indelible mark on the lifelines of remittance flows, which sustain the economies of many nations. In regions heavily reliant on remittances from overseas workers, a scarcity of dollars translates into diminished inflows of these vital funds. The consequences are dire for families dependent on remittances, resulting in financial instability and potential job losses across sectors that rely on this income. Furthermore, dollar shortages act as a deterrent for foreign workers, shrinking the pool of skilled labor available for employment. The consequences reverberate throughout the job market, amplifying the strain on the workforce.

Tumultuous Exchange Rates and Uncertain Prospects

Dollar shortages fuel exchange rate volatility and sow seeds of economic uncertainty. Fluctuating exchange rates cast a shadow of doubt over businesses, making it arduous for them to chart expansion plans, make informed investment decisions, or engage in timely hiring. The ensuing uncertainty triggers cautious employment practices, stifles job creation, and hampers wage growth, leaving the workforce in a precarious position. Furthermore, workers grapple with budgeting and financial planning amidst the capriciousness of exchange rates, impeding effective management of household expenses.

Informal Economy and Widening Income Disparities

Dollar shortages act as a catalyst for the growth of informal economic activities. As formal businesses grapple with accessing foreign currency, individuals turn to informal or black-market channels to secure dollars or engage in alternative economic endeavors. The burgeoning informal sector intensifies income inequalities and hampers the government's ability to collect taxes or regulate labor standards. In the absence of job security and social protections, workers find themselves at the mercy of vulnerability, perpetuating socioeconomic disparities.

Conclusion

Dollar shortages wield far-reaching consequences, casting a formidable impact on a nation's labor force, employment levels, wages, living standards, and overall economic landscape. However, amidst these challenges, the ability to receive dollars from outside the country can offer a glimmer of hope and a potential lifeline.

When individuals and businesses have the option to receive their dollars from external sources unaffected by the shortage, it can mitigate some of the adverse effects. By circumventing the limitations imposed by domestic currency scarcity, access to foreign dollars allows businesses to continue importing essential materials, maintain operations, and sustain employment levels. This external source of funds provides a lifeline for workers, preserving their jobs and income stability during times of currency turmoil.

Furthermore, the ability to receive dollars from abroad offers a means to counterbalance the inflationary pressures and erosion of purchasing power that often accompany dollar shortages. By having access to a stable foreign currency, workers can retain their ability to procure essential goods and services, ensuring their living standards are not disproportionately affected by the economic upheaval caused by the shortage.

In addition, receiving dollars from outside the country can provide a sense of financial security and stability. It allows individuals to diversify their assets and safeguard their wealth against the uncertainties of the domestic economy. It offers a means of protection against potential devaluation and inflation, assuring a more stable financial future.

Overall, the ability to receive dollars from external sources during a currency shortage acts as a crucial buffer, enabling businesses to thrive, workers to maintain their livelihoods, and individuals to secure their financial well-being. It underscores the importance of global interconnectedness and highlights the benefits of having access to diverse currency options in an increasingly interdependent world.

While addressing the root causes of dollar shortages remains paramount, the option to receive dollars from outside the affected country provides a valuable tool for mitigating the adverse impact on the workforce, promoting stability, and fostering resilience in the face of economic challenges.

Recent Articles

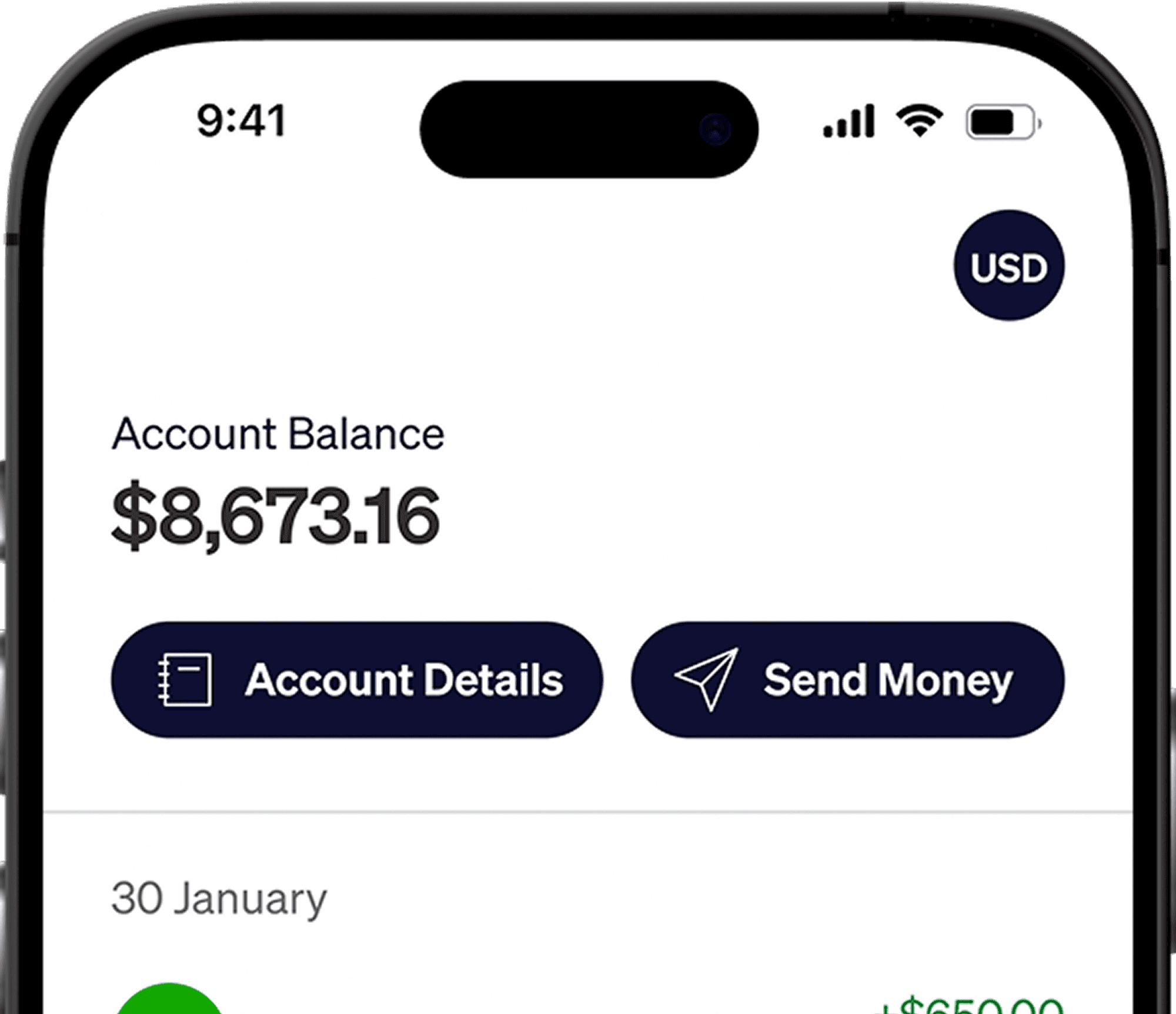

DO MORE WITH ELEVATE PAY

Transfer money with Elevate Pay with low fees and competitive FX rates. Our users love us for transparency, security and more.